Ignoring the states income taxes are progressive, this article delves into the complexities of progressive income tax systems, their impact on state revenue, and the ethical considerations surrounding tax evasion. Exploring alternative tax systems and the potential consequences of ignoring state income taxes, we uncover the intricate relationship between taxation and societal well-being.

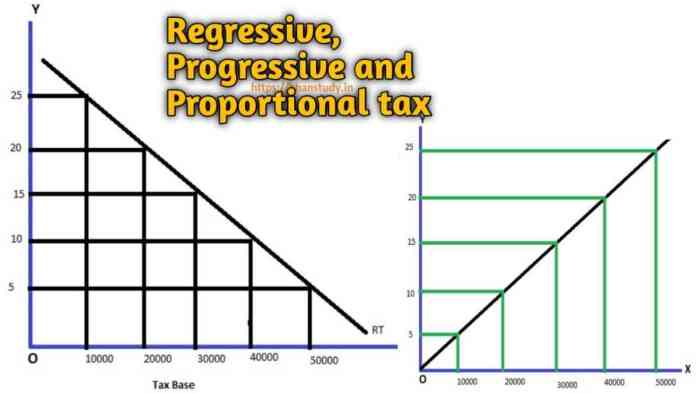

Progressive income tax systems, characterized by higher tax rates for higher earners, aim to redistribute wealth and promote social equity. However, the implications of ignoring these taxes extend beyond financial penalties, raising questions about fairness, public trust, and the rule of law.

Understanding Progressive Income Taxes

Progressive income taxes are a type of tax system in which the tax rate increases as the taxable income increases. This means that individuals with higher incomes pay a higher percentage of their income in taxes than individuals with lower incomes.

Progressive income taxes are designed to reduce income inequality and provide funding for public services.

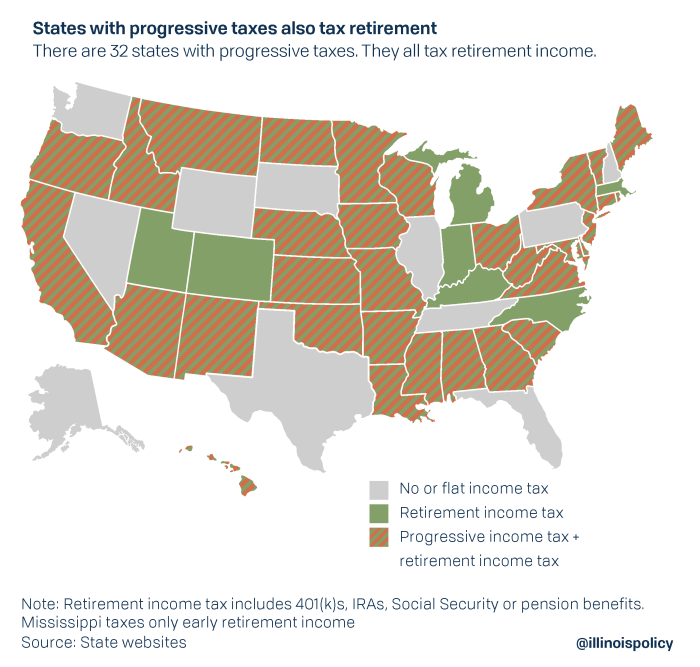

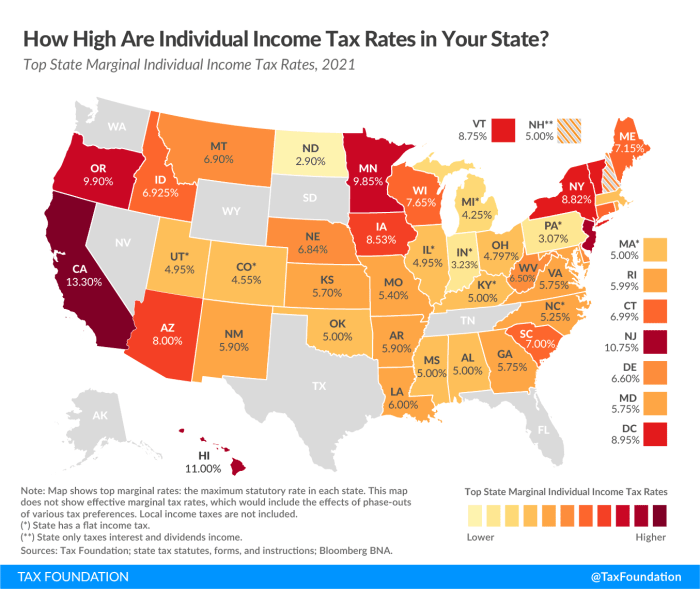

Progressive income tax systems are used in many countries around the world, including the United States, Canada, and the United Kingdom. In the United States, the federal income tax is progressive, with tax rates ranging from 10% to 37%. State income taxes are also typically progressive, with rates ranging from 0% to 13.3%.

There are a number of advantages to progressive income taxes. First, they can help to reduce income inequality. By taxing individuals with higher incomes at a higher rate, progressive income taxes can help to redistribute wealth and create a more equitable society.

Second, progressive income taxes can provide funding for public services. The revenue generated from progressive income taxes can be used to fund essential services such as education, healthcare, and infrastructure.

Impact of Ignoring State Income Taxes: Ignoring The States Income Taxes Are Progressive

Ignoring state income taxes can have a number of serious consequences. First, it is a crime. Tax evasion is a felony offense that can result in fines, imprisonment, and other penalties. Second, ignoring state income taxes can lead to financial hardship.

The state can seize your assets, garnish your wages, and even revoke your driver’s license. Third, ignoring state income taxes can damage your credit score. This can make it difficult to get a loan, rent an apartment, or buy a car.

Ethical Considerations

Ignoring state income taxes is not only illegal, but it is also unethical. Tax compliance is a fundamental obligation of citizenship. By paying our taxes, we contribute to the common good and help to ensure that essential public services are funded.

When we ignore our tax obligations, we are not only breaking the law, but we are also undermining the foundations of our society.

Methods of Avoiding State Income Taxes

There are a number of methods that people use to avoid paying state income taxes. Some of these methods are legal, while others are illegal. Legal methods of avoiding state income taxes include:

- Moving to a state with no income tax

- Claiming deductions and credits

- Sheltering income in tax-advantaged accounts

Illegal methods of avoiding state income taxes include:

- Not reporting all of your income

- Filing a false tax return

- Using offshore accounts to hide your income

Alternative Tax Systems

Progressive income taxes are not the only way to raise revenue for public services. There are a number of alternative tax systems that could be used instead. Some of these systems include:

- Flat tax

- Value-added tax (VAT)

- Land value tax

Each of these tax systems has its own advantages and disadvantages. The best tax system for a particular country will depend on a number of factors, including the country’s economic conditions, its political system, and its social values.

FAQ

What are the potential consequences of ignoring state income taxes?

Ignoring state income taxes can result in legal penalties, including fines, imprisonment, and asset forfeiture. It can also damage an individual’s credit score and make it difficult to obtain loans or other financial services.

What are the ethical implications of ignoring state income taxes?

Ignoring state income taxes undermines the principle of fairness and erodes public trust in the government. It also shifts the tax burden to those who comply with the law, potentially exacerbating social and economic inequalities.

What are some alternative tax systems that could replace progressive income taxes?

Alternative tax systems include flat taxes, consumption taxes, and wealth taxes. Each system has its own advantages and disadvantages, and the choice of which system to adopt depends on factors such as revenue needs, economic growth objectives, and social equity considerations.